Enhanced premium tax credits (PTCs), which were established to lower premiums and make health insurance more affordable for people enrolled in marketplace plans, are set to expire at the end of 2025. Congress is considering whether to make them permanent, extend them with or without structural changes, or allow them to expire

A recent study by the Urban Institute estimated that allowing the enhanced PTCs to expire would cause average net premiums, the portion paid by families after their tax credits, to increase more than 400 percent for marketplace enrollees with incomes below 250 percent of the federal poverty level ($39,125 for an individual or $66,625 for a family of three) and double for marketplace enrollees with incomes above 250 percent of the poverty level. This would result in 7.3 million fewer people receiving subsidized marketplace coverage and 4.8 million more people uninsured in 2026. These coverage losses would reduce total spending on hospital services by $14.2 billion and increase hospitals’ uncompensated care costs by $2.2 billion in 2026.

This kind of revenue loss and uncompensated care would have substantial financial consequences for hospitals — and for rural hospitals disproportionately. About 18 percent of people who enrolled in coverage through HealthCare.gov in 2025 live in rural areas; rural residents disproportionately benefit from the enhanced PTCs. As a result, rural hospitals may be disproportionately adversely impacted by the expiration of the tax credits.

Rural hospitals run on slim operating margins and operate at a loss with respect to patient-care margins. Negative patient-care margins mean that payments to hospitals for treating patients are insufficient to cover operating costs. Therefore, hospitals need to find other revenue sources or negotiate higher rates with commercial insurers to cover these losses, which may be unsustainable in the long term. Furthermore, rural hospitals often have less bargaining power than their urban counterparts, making it more difficult to negotiate rates.

Hospitals in rural communities have been closing at an alarming rate. Since 2005, 195 rural hospitals either have closed or have ceased inpatient care (and only provide outpatient services). A further reduction in operating margins could intensify this trend. More than 750 rural hospitals — a third of all rural hospitals — are currently at risk of closing; more than 300 are at immediate risk of closure.

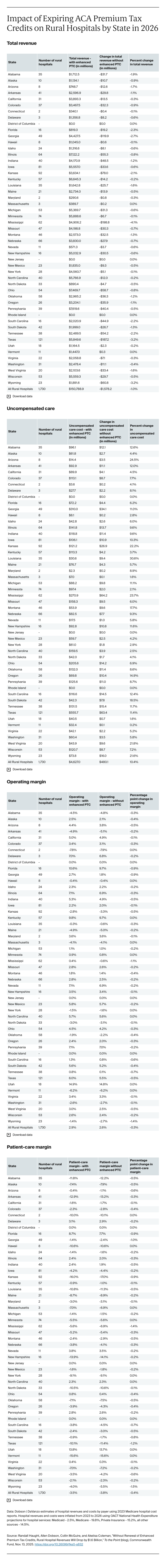

Using Urban Institute’s estimates of coverage loss and hospital uncompensated care increases, we looked at the potential financial impact on rural hospitals if the enhanced PTCs expire. Across the 1,730 rural hospitals in our database, we estimate that net patient revenues would decline by $1.6 billion (1% of rural hospital operating revenues), uncompensated care costs would increase by more than 10 percent, and operating margins would decline by nearly 10 percent in 2026, further eroding operating margins for these already struggling hospitals. Patient-care margins would be further reduced from –3.5 percent to –3.8 percent (or about a 10 percent reduction), adding increased pressure on rural hospitals to reduce costs or find other sources of income.

Rural hospitals in states that did not expand Medicaid under the Affordable Care Act would be even more adversely impacted. The Urban Institute estimates that 65 percent of the marketplace coverage loss would occur in the 10 nonexpansion states. Rural hospitals in Mississippi, for example, would see total revenues reduced by $199 million (a 4% reduction), uncompensated care costs increased by 23.7 percent, and patient-care margins further reduced from –5.6 percent to –6.9 percent (about a 23% reduction). For changes in total hospital revenues, uncompensated care costs, operating margins and patient-care margins for rural hospitals in each state, please see the exhibit.