Access to private health insurance through the Affordable Care Act (ACA) marketplaces is expected to tighten because of reduced subsidies (in the form of tax credits) and increasing premiums. As a result, nearly 2 million community health center (CHC) patients are likely to lose their coverage, with even greater losses likely in the coming years as patients struggle with high costs.

CHCs play an important role in helping patients get health insurance coverage through both the ACA marketplaces and Medicaid. The coverage expansions have fueled health center growth: between 2013 and 2024, CHC capacity grew by 50 percent, from 21 million people served in 2013 to more than 32 million by 2024. Health centers are a principal source of primary care and are essential to provider networks offered by Medicaid managed care organizations and marketplace plans. Marketplace coverage is especially important in states that have not adopted the ACA Medicaid expansion because eligibility for subsidies in these states begins at 100 percent of the federal poverty level (i.e., $26,650 for a family of three) rather than the higher threshold of 138 percent of poverty in expansion states (i.e., $36,777 for a family of three).

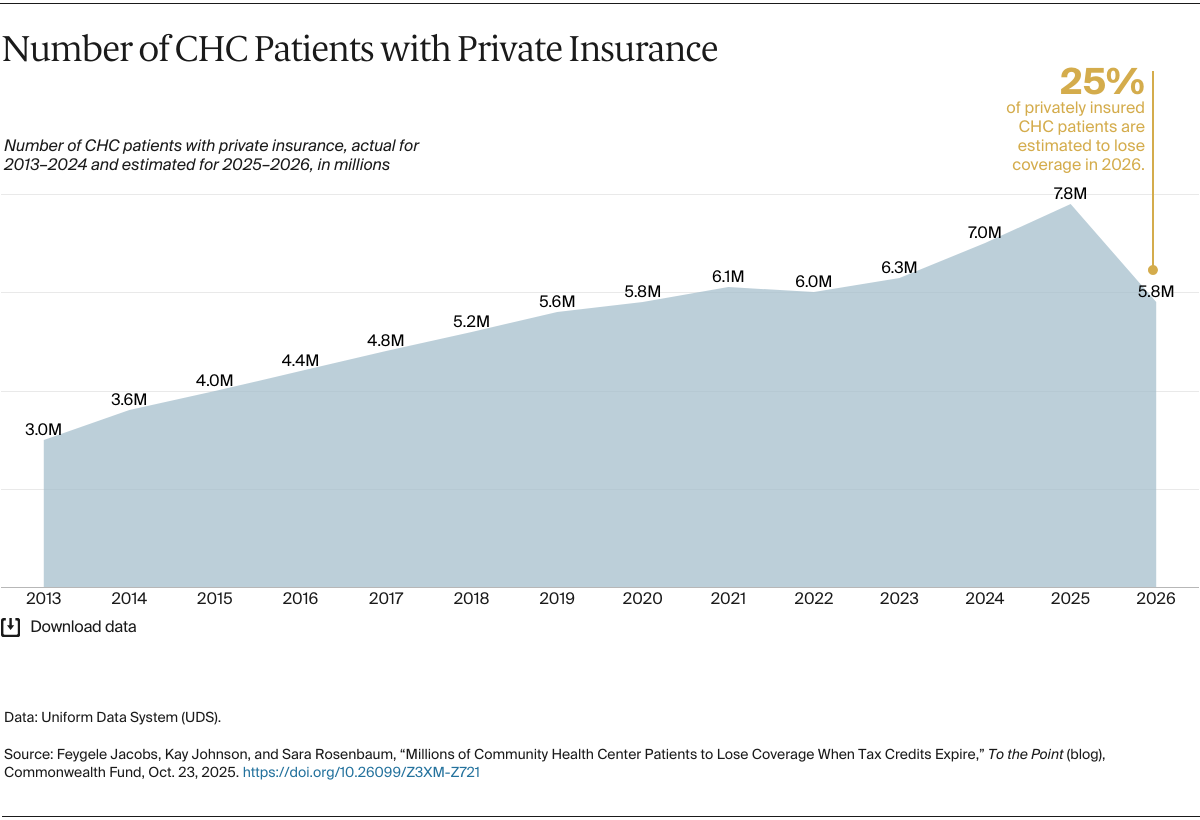

But beginning with the 2026 plan year, the health insurance marketplace will experience major changes that carry serious implications for CHCs and their patients. Unless Congress acts, enhanced premium tax credits for the ACA marketplace will expire at the end of 2025. We estimate that the loss of enhanced premium tax credits, coupled with increased barriers to enrolling and renewing marketplace coverage, will immediately affect millions of CHC patients. Over time, coverage losses could swell further as patients struggle with increased coverage costs. CHCs will face billions of dollars in lost revenue as patients become uninsured, and the centers continue to offer care to their patients regardless of their insurance coverage or ability to pay.

For CHCs and their patients, the most consequential changes stemming from the statutory and regulatory reforms will include the loss of enhanced premium tax credits, the loss of tax credit eligibility for many legal immigrants and young adults who came to the United States as children and are protected under the Deferred Action for Childhood Arrivals (DACA) program, an end to the special-enrollment period for the lowest-income consumers, a shortened enrollment period, and an end to autorenewal.

We can estimate the impact on private coverage among health center patients by examining statistics on employer coverage for low-wage earners generally. All CHCs report data to the Uniform Data System (UDS), which tracks expansion in patient coverage by capturing annual information on both public and private insurance. When it comes to private insurance coverage, UDS does not distinguish between employer and marketplace plans; it reports all private coverage in aggregate. These data show that over the 2013–2024 period, the proportion of low-wage workers with employer coverage remained stagnant at about 24 percent. The CHC trend mirrors the broader population: as marketplace coverage grew generally, so did the proportion of CHC patients with private insurance, indicating that the coverage growth among CHC patients can likely be attributed to ACA plans.