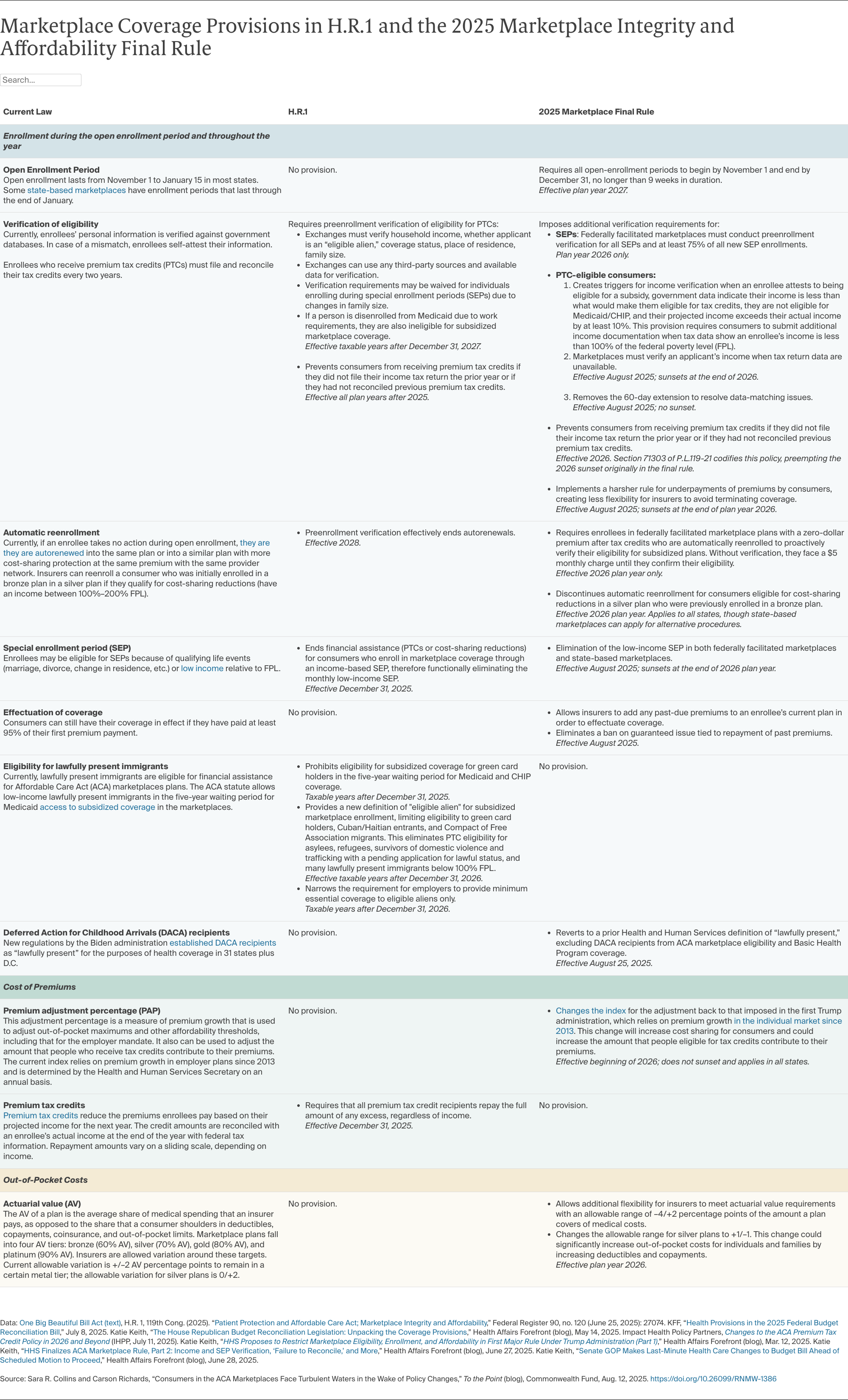

- People with low incomes will have significantly decreased enrollment opportunities and face new scrutiny about their eligibility for coverage. The policies eliminate monthly special-enrollment periods for people with low incomes, effective August 2025, and block states from pursuing policies to implement these periods. This provision alone could leave an estimated 400,000 low-income people uninsured. The Trump administration particularly scrutinizes people who attest to having incomes above 100 percent of the poverty level if tax data indicate their incomes might be below the poverty level, which makes them ineligible for marketplace coverage.

- People will be unable to autoenroll. In 2025, nearly 11 million marketplace enrollees — 45 percent of the total enrollment — were autoenrolled in plans they had selected the year before. Starting in 2026, the Trump administration will charge autoenrolled low-income people with fully subsidized premiums a $5 fee until they pay their first premium. Then, starting in 2028, H.R. 1 effectively imposes a total ban on autoenrollment in all states in 2028 by requiring consumers seeking to renew their coverage to provide proof of income, alien status, and other information required by the HHS Secretary. Loss of autoenrollment would increase the number of uninsured by 700,000 by 2034.

- Open-enrollment periods will be shorter, and states will be unable to set their own timelines. Beginning in 2027, open enrollment in all states could be two weeks shorter than the current federal period and up to a month shorter than the current period in some states.

- People who apply for coverage outside the open-enrollment periods will face increased scrutiny. Special-enrollment periods help people keep health insurance after job loss or other life changes. The new law increases the amount of red tape people face in these circumstances, ensuring that more will experience coverage gaps. People who lose Medicaid because of new work requirements will be ineligible for premium tax credits even during open enrollment.

- People may not be guaranteed coverage. Before the ACA, insurance companies that sold plans in the individual market could deny coverage to people because of preexisting health conditions and other factors. The ACA banned this practice by establishing “guaranteed issue.” Beginning August 5, the Trump administration allows insurers to refuse policies to people who have any past premium debt, a practice specifically banned under the ACA.

In addition to making it harder to enroll in coverage, the law will make premiums more expensive because:

- Enhanced premium tax credits are set to expire at the end of 2025; so far, Congress has not extended them. Without an extension, premiums will spike by an average of 75 percent, meaning an annual increase of $387 to $2,914, depending on income. Six million to 7 million fewer people are projected to enroll in marketplace plans and 4.2 million people will become uninsured as a result.

- The Trump administration could increase premiums for people who receive tax credits by changing the way they measure annual premium growth. The so-called premium adjustment percentage is used by the federal government to determine annual increases in what people who receive tax credits contribute to their premiums each year. The administration will now base this measure on premium growth in the employer market, which was previously used by the Biden and Obama administrations, as well as the individual market, with the latter being more volatile and sensitive to policy changes, like the recent significant policy changes.

- Marketplace insurers are requesting higher premiums because of anticipated enrollment declines and tariffs. Higher premiums and red tape will discourage healthier people from getting covered, leaving less healthy people in the marketplaces. Insurers will further increase premiums to cover these higher expected costs. Some insurers have filed preliminary premium requests to state regulators for 2026. On average, they are asking for 4 percent higher premiums due to the expiration of the tax credits and some insurers are asking for 3 percent higher premiums because of the Trump administration’s tariffs, which are expected to raise prices of pharmaceuticals. Insurers are expected to request further premium increases as they assess the full effects of the new policies.

Out-of-pocket costs also will be higher because the policy changes will:

- Raise out-of-pocket maximums for all commercial health plans. The change to the premium adjustment formula will also increase out-of-pocket maximums for health plans, including employer plans. In 2026, the new out-of-pocket maximums will climb by 15 percent to $10,600 for individual plans and $21,200 for family plans. These are 4 percent higher than under the Biden administration’s approach.

- Increase the likelihood that consumers will have plans with higher deductibles and copayments. This is because the Trump administration gives insurers greater flexibility to meet requirements for the share of costs that they cover when consumers use their plans to get health care.

- Reduce the ability for people to enroll in plans that give them maximum protection from health care costs. The Trump administration is eliminating the ability of marketplaces to automatically reenroll people into plans that give them maximum cost protection, either at the same or lower premium and with the same provider network. This will have the effect of increasing cost sharing.

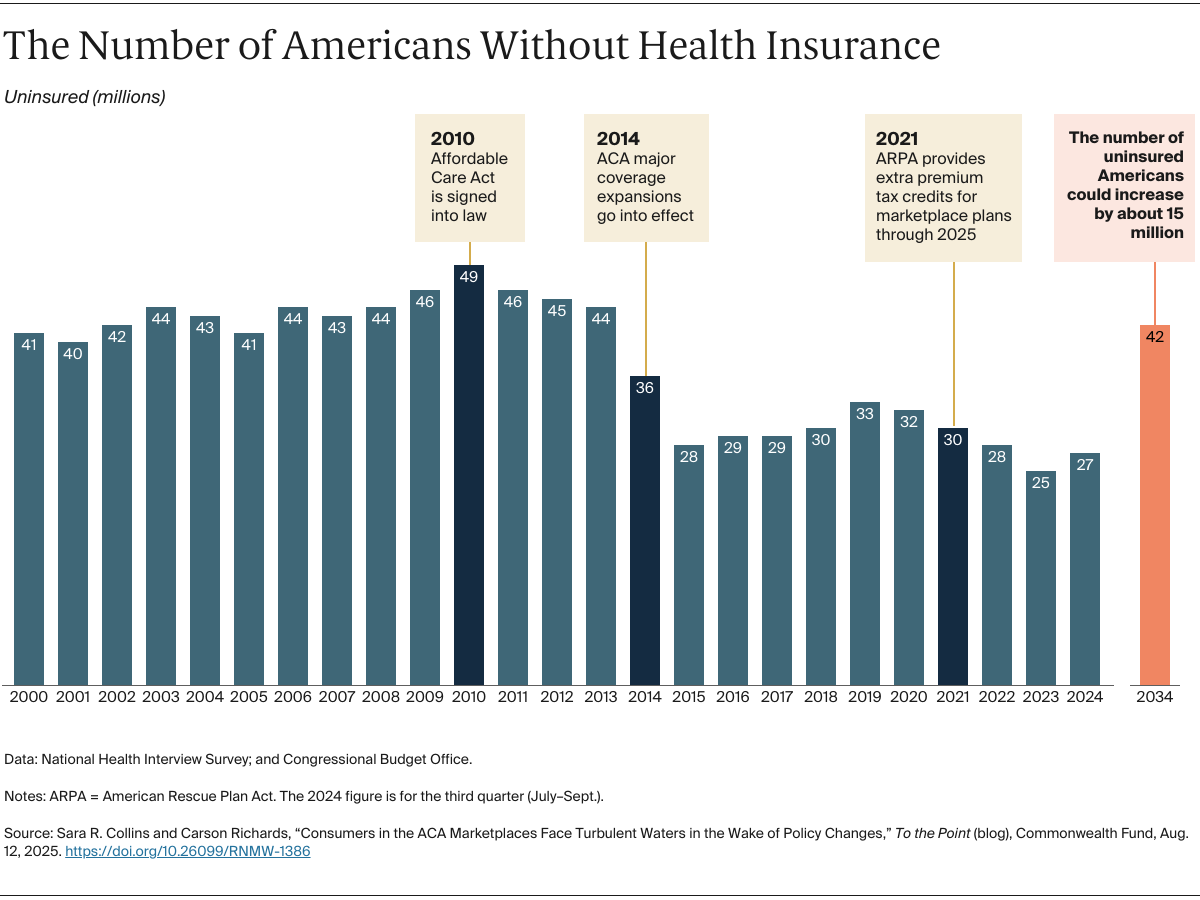

Millions More Uninsured, Less Affordable Marketplaces, and Sicker Americans

The combined policy changes could lead to more than 11 million fewer people enrolling in marketplace plans over time. While some will gain insurance coverage elsewhere, about 7 million people in this group could become uninsured. When combined with H.R. 1’s cuts to Medicaid, at least 15 million more people could be uninsured in 10 years. This could drive the overall number of uninsured people to above 40 million by 2034, not far from pre-ACA levels. Those who remain covered will face higher premiums and out-of-pocket costs when they get health care.

Far from making people healthy again, this unprecedented damage to the nation’s health insurance system will cause millions of Americans to experience unnecessary suffering, higher health care costs, poorer health, and shorter lives.