Introduction

At the end of 2025, Americans who buy their health insurance on the Affordable Care Act (ACA) marketplaces will no longer have access to enhanced premium tax credits to help defray the cost of their coverage. If Congress takes no action to extend them, nearly 5 million people are estimated to become uninsured in 2026, and insurance premium costs will soar for millions more.1

The end of this enhanced financial assistance for low- and middle-income Americans has become a sticking point in the ongoing congressional debate over a continuing resolution (CR) to extend funding for the federal government in fiscal year 2026, which began on October 1, 2025. Democrats in Congress are seeking to extend the enhanced marketplace tax credits to prevent health insurance costs from rising and prevent people from becoming uninsured. Democrats also request the cancellation of cuts to Medicaid and other health coverage included in the tax and spending bill, H.R. 1 (also referred to as the One Big Beautiful Bill Act or the Working Families Tax Cut Act), passed in July. For their part, congressional Republicans and the White House say they want to pass a “clean” CR immediately —simply extending prior funding levels without additional conditions — but might consider negotiations to revise the ACA subsidies later in the year.2

As of mid-October, the CR and the fate of the enhanced marketplace subsidies are up in the air, as neither Republicans nor Democrats have the 60 votes needed in the Senate to pass a CR.

In this brief, we draw on recent data provided by the Urban Institute and the Congressional Budget Office (CBO) to update our analysis from earlier this year exploring the economic impact of letting the enhanced ACA marketplace tax credits expire.3 CBO estimated that it would cost the federal government $31 billion to restore the expiring credits and make related changes.4

Using 2025 data on the number of people selecting ACA marketplace plans, Urban Institute researchers have estimated that the end of enhanced tax credits will lead to 7.3 million people losing their ACA coverage in 2026, of whom 4.8 million would become uninsured. The loss of the additional subsidies are projected to increase how much marketplace enrollees must pay by an average of 114 percent, from an average of $888 to $1,904 per year.5 The higher costs will exceed the budget of many Americans, forcing about 2.5 million to shift into other coverage,6 while nearly 5 million become uninsured. Previous research found that those who lose their health insurance may experience prolonged periods without coverage, either because of their inability to afford it or because of the burdensome paperwork required to obtain new coverage.7

Economic Impact Findings

National Impact

For our updated analysis, we used the IMPLAN economic modeling system to estimate the national impact of allowing enhanced premium tax credits to expire in January.8 Here are the key findings:

- Federal funding for marketplace premium tax credits will decline by $31 billion in 2026 from current levels.

- The resulting reductions in funding for health care, together with related downstream economic effects for businesses that serve health providers and their staff, will cause state economies (gross domestic products, or GDPs) to fall by about $40.7 billion. The loss to state economies would be 31 percent greater than the amount the federal government would save from not providing the enhanced tax credits. These estimates are conservative.

- Approximately 339,100 jobs are projected to be lost in 2026, as loss of income forces health care providers and other businesses to reduce their workforces. Slightly less than half of these jobs (154,000) will be health care–related, while the rest (185,000) will be in other sectors of the economy.

- The loss of individual and business income will cause state and local tax revenues to decline by $2.5 billion.

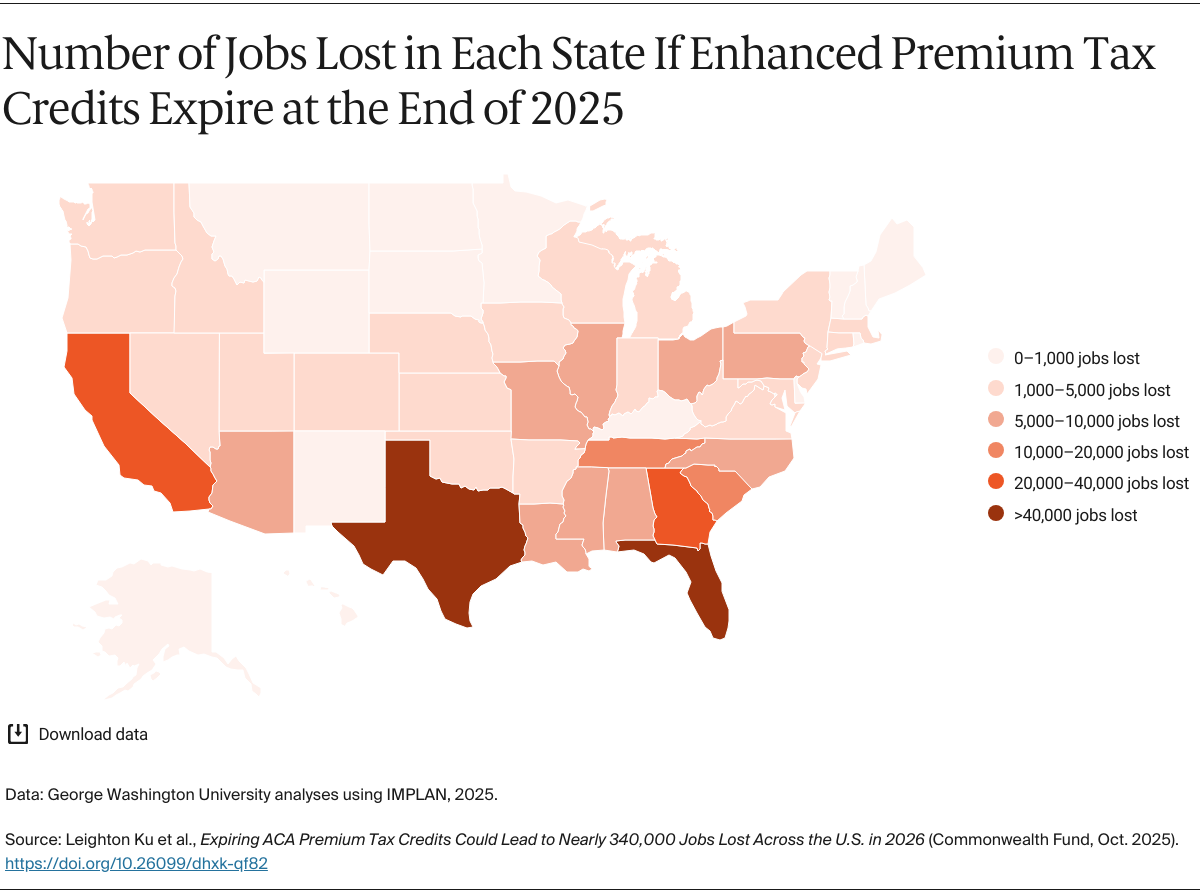

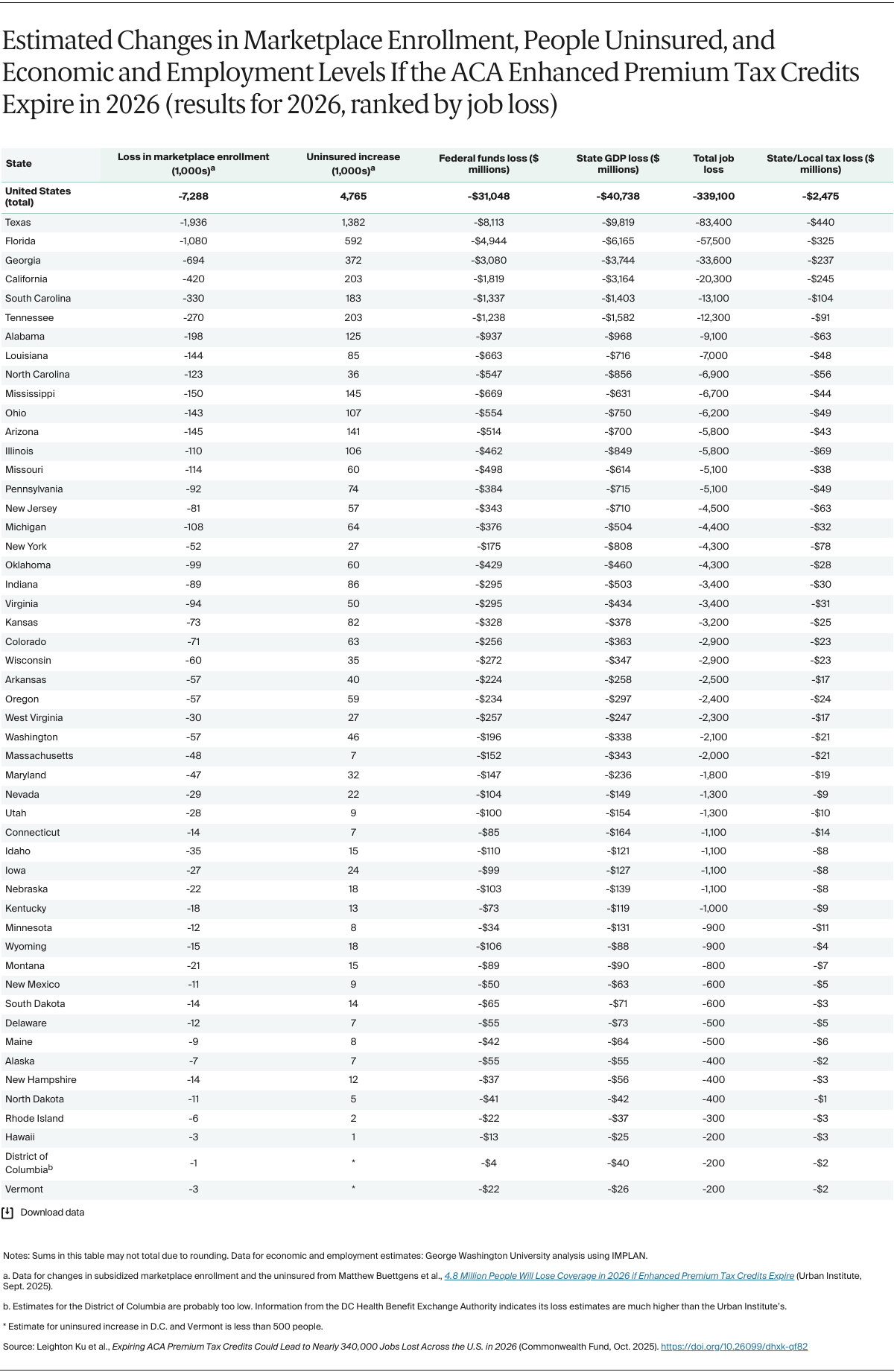

State-Level Impact

We also produced economic estimates for each of the 50 states and the District of Columbia, shown in Exhibit 1. Following are some highlights:

Losses will be higher in states where more residents are enrolled in an ACA marketplace plan. The 10 states with the most projected jobs lost are:

- Texas: 83,400

- Florida: 57,500

- Georgia: 33,600

- California: 20,300

- South Carolina: 13,100

- Tennessee: 12,300

- Alabama: 9,100

- Louisiana: 7,000

- North Carolina: 6,900

- Mississippi: 6,700.

These 10 states will collectively lose about 250,000 jobs, accounting for three-quarters of the jobs lost across the United States. Not only will employment weaken in these states, but their residents will also have to spend more of their disposable income on health insurance.

- Since seven of those 10 states (Texas, Florida, Georgia, South Carolina, Tennessee, Alabama, and Mississippi) did not expand Medicaid eligibility, their residents who would otherwise have been eligible for Medicaid often instead rely on insurance coverage through the ACA marketplaces. States that did not expand Medicaid generally have more uninsured residents, so the loss of marketplace coverage worsens their coverage gaps.

- All states will have lower GDPs, fewer jobs, and less state and local tax revenue if the enhanced marketplace financial help expires.