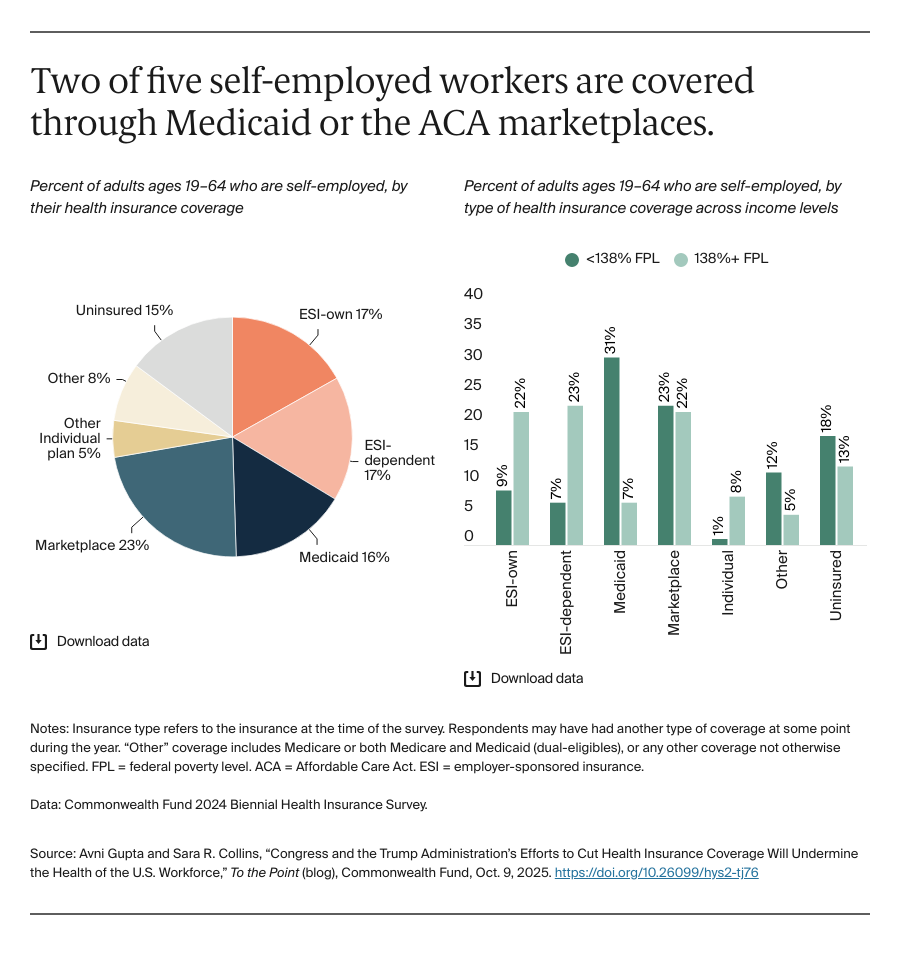

In May 2025, nearly 163 million people in the United States were employed either full or part time. Employer coverage forms the backbone of the health insurance system, but not all working people get coverage through their jobs — not all firms offer coverage and, even when they do, not all workers are eligible. The Affordable Care Act’s (ACA) coverage expansions help many of these working adults obtain coverage. Currently, more than 23 million Americans get their coverage from the marketplaces and about the same through the ACA’s Medicaid expansion.

But the budget reconciliation law (H.R. 1), along with the potential expiration of the enhanced premium tax credits and the Trump administration’s final rule on the marketplaces, will bring major changes to Medicaid and marketplace coverage. Estimates from the Congressional Budget Office and the Urban Institute show that the combined effects of these changes will increase the number of uninsured people by about 15 million in 2034. This could drive the overall number of uninsured above 40 million, close to pre-ACA levels. Using data from the Commonwealth Fund 2024 Biennial Health Insurance Survey, we examine how these major federal policy changes will affect the lives of working Americans.

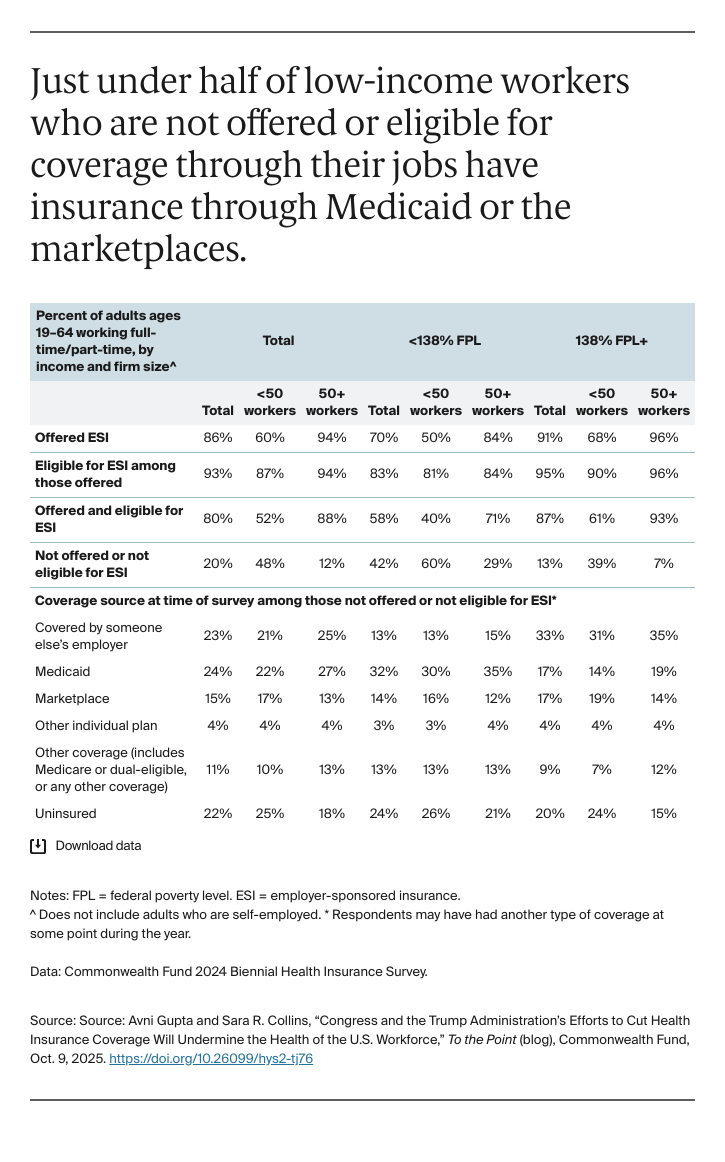

According to the survey, 80 percent of full- or part-time workers were employed in firms where they were both offered and eligible for coverage through their companies. But there was wide variation, by firm size and income. Only 40 percent of workers in small firms (i.e., fewer than 50 workers) with incomes under 138 percent of the federal poverty level (i.e., $20,782 for an individual and $43,056 for a family of four in 2024) were both offered and eligible for their workplace coverage. In contrast, 71 percent of workers in the same income group in larger firms (i.e., 50 or more workers) were offered and eligible for coverage. There were similar divides among workers with higher incomes: among those with incomes at 138 percent of the federal poverty level or higher, 61 percent in small firms were offered and eligible for coverage compared to 93 percent of those in large firms. Part-time workers were both less likely than full-time workers to be employed by firms that offered insurance and to be eligible for coverage in firms that did offer health benefits (data not shown).