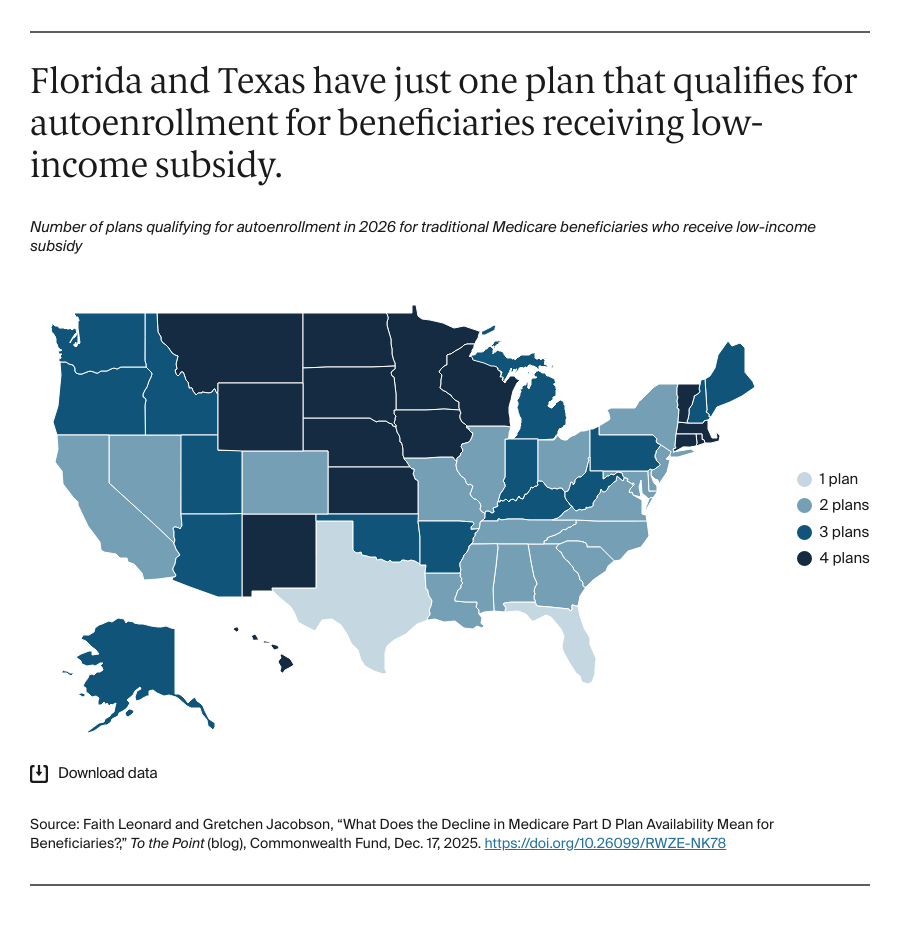

Beneficiaries who qualify for the Medicare low-income subsidy (LIS) program may find even fewer available options in 2026. LIS covers Part D plan premiums and cost sharing for beneficiaries with low incomes. In 2025, qualifying beneficiaries had annual incomes below $23,475. Beneficiaries who qualify for LIS will be autoenrolled in coverage with premiums at or below CMS regional benchmarks, unless they choose a plan or have chosen one in prior years. LIS-qualifying beneficiaries also may enroll in Medicare Advantage plans and access prescription drug coverage that way.

In 2026, every state will have four or fewer PDPs that qualify for LIS autoenrollment, down from nine or fewer in 2022. In Texas and Florida, only one PDP will qualify for LIS autoenrollment; all LIS beneficiaries who did not previously choose a plan will be enrolled in this plan. In both Texas and Florida, LIS enrollees will be limited to the formularies and pharmacy networks offered by the one available plan.

Discussion

Medicare beneficiaries have choices for prescription drug coverage, but the reduction in options raises questions. How many choices is too few? Why are there fewer PDPs now than in prior years? Are beneficiaries able to enroll in plans that cover all of their prescriptions, or do they need to change their prescriptions, use discount websites, or find other workarounds? With fewer options available, are low-income beneficiaries who are autoenrolled into qualifying plans able to afford and access their prescriptions at convenient pharmacies?

Drug prices continue to be a top concern for beneficiaries. In 2022, 14 percent of beneficiaries age 65 and older reported they did not fill a prescription due to costs, in both Medicare Advantage and traditional Medicare. One in five beneficiaries in traditional Medicare reported purchasing prescription drugs through discount websites, like GoodRx, CostPlus, or Amazon, rather than using their Part D drug coverage. Most of these beneficiaries (85%) said they used discount websites because their out-of-pocket costs were lower than with their Part D plans, suggesting that Part D markets may not be providing sufficient competition to meet beneficiaries’ needs. Provisions from the Inflation Reduction Act intended to help lower drug costs for beneficiaries are still being implemented, including the second round of drug price negotiations. In addition, all beneficiaries’ out-of-pocket costs for drugs covered by their Part D plan are now capped (at $2,100 for 2026).

While a similar share of beneficiaries in Medicare Advantage versus traditional Medicare report challenges affording needed health care, one study found that beneficiaries are paying more for drugs in PDPs than in MA-PDs. Medicare Advantage enrollment growth persists, but many Medicare beneficiaries continue to choose traditional Medicare and rely on PDPs for their drug coverage. Regardless of whether beneficiaries choose to enroll in Medicare Advantage or traditional Medicare, it is important that the Medicare markets provide coverage that is affordable for beneficiaries and the federal government and that allows beneficiaries to get the health care they need.