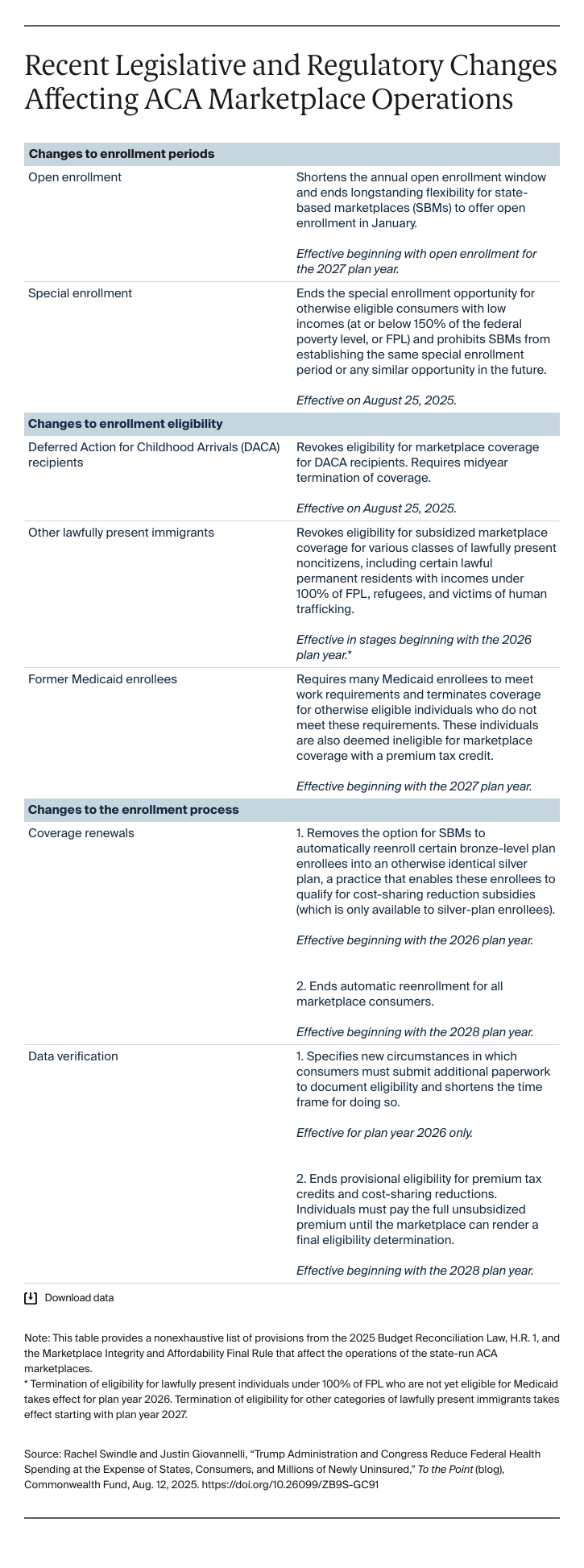

SBMs also have less flexibility than they did previously to manage the dates of their annual open-enrollment periods. In the past, consumers could enroll at least through mid-January in many SBMs. But starting next year, SBMs must end their open-enrollment periods no later than December 31st. This will be a marked departure — all but one SBM extends enrollment through mid to late January –– that will add to consumer confusion and increase burdens on state workers and consumer assisters during the busy weeks surrounding the December holidays.

The demands will increase in preparation for the 2027 and 2028 plan years. New work requirements and eligibility redetermination rules for Medicaid enrollees that take effect by 2027 will require technical and operational changes for SBMs, which serve as a coverage access point for this population and have eligibility and enrollment systems that are, to varying degrees, integrated with Medicaid. By 2028, marketplaces will be forced to scrap automatic reenrollment. Stopping states from allowing existing enrollees to automatically remain in their plans — an option used by more than 70 percent of SBM enrollees and that is widely available to people with job-based coverage — would fundamentally alter how the marketplaces have served consumers for more than a decade. This will require still more changes to both back-end and consumer-facing IT systems, and result in at least 700,000 uninsured people.

Communications Challenges

Communicating these changes and their consequences for consumers also requires significant time, planning, staff resources, and funding. The changes to longstanding eligibility and enrollment rules described above, combined with Congress’ refusal to extend enhanced marketplace tax credits beyond the end of this year, will spur misunderstanding among consumers and stakeholders alike, and states will be the point of contact for triaging problems. Some of the new policies take effect in August, others begin with open enrollment for the 2026 plan year. This means SBMs have just a few months to prepare staff, enrollment partners, and consumers. SBMs often partner with external stakeholders and organizations to provide outreach and education services and to boost call center staffing for open enrollment. Many have already completed or are concluding the contracting process and might have to change these agreements or increase their budgets to address federal policy changes.

However, the precipitous declines in marketplace enrollment expected from the Centers for Medicare and Medicaid Services and Congress’s approach could significantly reduce marketplace budgets (i.e., in most states these are tied to enrollment-based assessments on insurers), leaving many SBMs with diminishing resources to address these serious challenges on top of new budgetary uncertainties. For example, provisions in the budget law that revoke eligibility for many lawfully present immigrants will cause hundreds of thousands of New Yorkers to lose coverage through the state’s Essential Plan and cost the state billions of dollars in funding. There will be a significant impact to the risk pool, as those who will lose coverage are younger and healthier, leading to a worsening risk pool and higher-cost enrollees. This double blow threatens the long-term viability of what has been a hugely successful coverage program.

A Compromised Mission

States that committed to running their own ACA marketplaces did so to improve their residents’ access to affordable private health insurance, using the autonomy and control the state-based marketplace model has long offered. Recent federal policy changes would pull the rug out, limiting state power, compromising the marketplaces’ mission, and endangering the health of millions.