The health care provisions of the budget reconciliation law, combined with newly adopted Trump administration regulations for Affordable Care Act (ACA) marketplace coverage, impose enrollment barriers and higher costs on people who buy insurance coverage on their own. Among the millions affected are workers whose employers, in lieu of offering them insurance, have directed them to shop for coverage in the individual marketplace using employer-funded accounts. As the policy changes to the individual market take effect, workers with these accounts will face a market that is harder to navigate and far more costly than it is now.

Recent Federal Policy Changes Weaken the Individual Market

In the past five years, enhanced premium tax credits, extended opportunities to enroll, and reduced barriers have made possible historic enrollment in the ACA marketplaces. Enrollment totaled more than 24 million in 2025, double the number in 2020. The budget reconciliation law and recent Trump administration regulatory policies make significant changes to key protections. Those shopping in the marketplace will find it much harder to get and keep coverage, while coverage itself, whether on-marketplace or off, will be much more costly. What’s more, Congress appears unwilling to keep the enhanced premium tax credit in place, a choice that would lead to millions more uninsured. All told, individual market enrollment is projected to decline by more than half.

Because administrative burdens and high premiums discourage enrollment by healthy consumers, policies that make coverage harder and more costly to access worsen the risk pool. This contributes to much higher premiums for everyone who relies on the individual market.

Employers Can Offer Individual Coverage Accounts in Lieu of Group Coverage

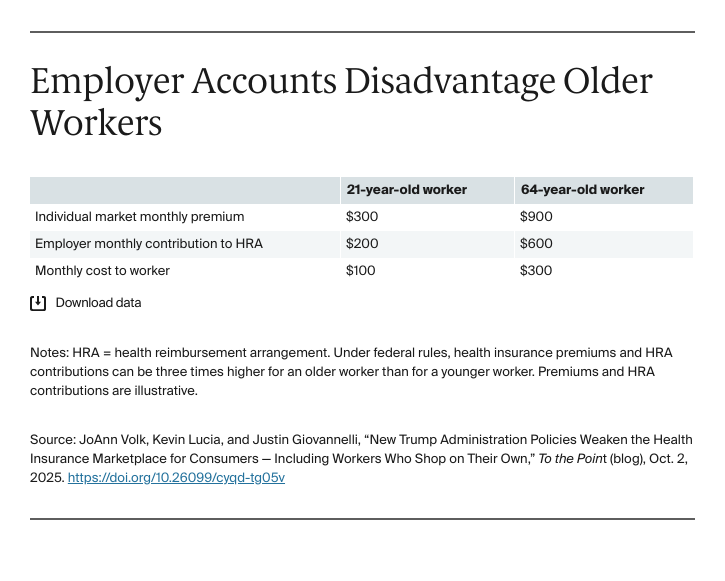

A 2019 federal rule created Individual Coverage Health Reimbursement Accounts (ICHRAs), which allow employers to provide funds for employees to buy individual plans that meet ACA rules. Employers can decide to offer ICHRAs (rather than a traditional group health plan) to a subset of employees based on employment distinctions. For example, an employer may offer ICHRAs to hourly workers or those who work at a particular location or plant and a group health plan to its salaried workers or those working in the company headquarters. While federal rules establish minimum thresholds for employer contributions to their employees’ coverage costs, businesses can satisfy these standards and still leave workers unable to afford individual market premiums with their ICHRA funds. This is a particular risk for older workers and those living in high-cost areas. For example, while employers can contribute more to older workers’ ICHRAs, those workers would face higher premiums in the individual market than their younger coworkers and the greater employer contributions wouldn’t make up the difference.

A Weakened Individual Market Undercuts the ICHRA Option

Relatively few employers offer ICHRAs: well under 10 percent of firms made ICHRAs available to their workers in 2024 and comprehensive data on the number of workers who actually enroll in this coverage are unavailable. Sending workers to the marketplace, where coverage can be less generous and with tighter provider networks than the typical employer plan, poses a danger that some workers will be made worse off, particularly older workers and those with low incomes or high-cost conditions. The recent policy changes to the individual market greatly exacerbate this risk.

To make Individual Coverage Health Reimbursement Arrangements at all viable, employees must have access to a robust individual market. As a result of the policy changes, enrollees will face higher premiums and cost sharing. Employers hoping to direct employees to obtain coverage in this weakened market with ICHRAs will be providing a far less attractive coverage option for workers. Employees will find it much harder to obtain and keep coverage than would be the case with employer plans.

Looking Ahead

Individual coverage accounts have been a key part of some proposals to improve coverage for employees. Though little used to date, they may become more attractive to employers in a softening labor market, particularly in the face of rising and uncertain business costs. Individual accounts offer an alternative option for helping workers get coverage, with costs that are both predictable and controllable for employers. But whether they are an attractive option for employers and their workers — or even a viable option — depends entirely on having a stable, affordable, accessible individual market. The newly adopted changes to the market put that very much in question.