As we face a new year, we are experiencing nationwide double-digit commercial premium increases that are making annual family health insurance premiums more than the price of a new compact car. States are finding ways to tackle a primary driver of the spending growth behind these increases: unfair and excessive hospital prices.

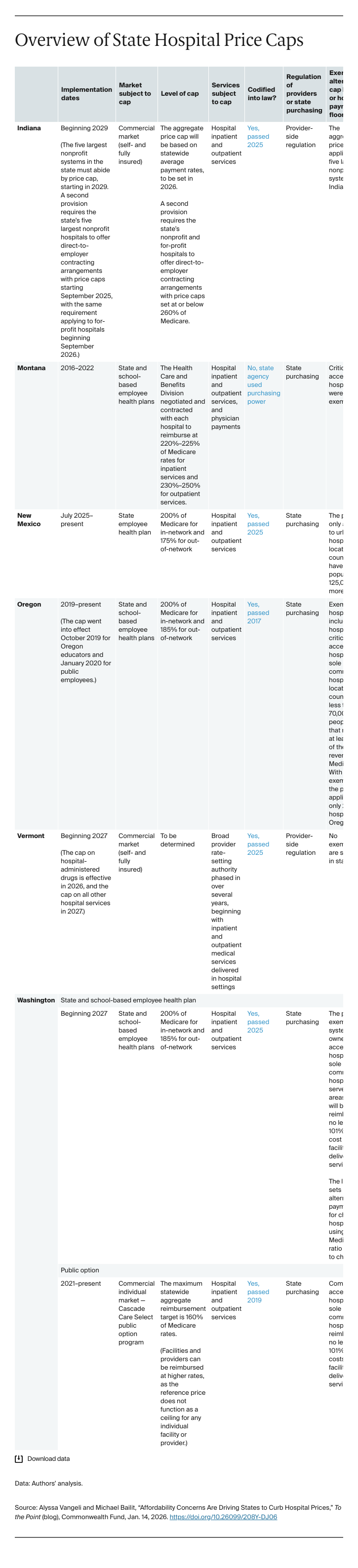

In 2025, several states intervened to blunt the impact of rising commercial hospital prices on families, businesses, and taxpayers. These actions build upon ones taken previously in other states, like California, Montana, Oregon, and Rhode Island. They generally fall into two categories: those targeting the full commercial market and those focused on public employee health plans.

State Action Targeting the Full Commercial Market

Indiana

Indiana employers have pointed out that the state’s hospitals are paid among the highest commercial prices in the nation. In 2025, legislators passed House Bill 1004, which will require the state to set a hospital price cap in 2026 based on average payment rates in the state. The five largest nonprofit hospital systems must limit their contractual prices to that cap by 2029 or forfeit their state nonprofit status and potentially pay fines. The bill also requires those systems and for-profit hospitals to offer direct-to-employer contracting arrangements with price caps.

Vermont

In 2025, Vermont’s health system found itself in a precarious situation: premiums in the Affordable Care Act marketplace were far above national averages, spending was growing rapidly at the state’s largest hospital, the state’s leading insurer was on the edge of insolvency, and poor financial performance plagued several small hospitals. The state legislature acted boldly in response, creating a statewide cap on commercial hospital prices for administered drugs effective January 2026, and then going further to require a cap on commercial hospital prices by 2027. Vermont’s 2026 marketplace premiums were the highest in the nation across all plan types; the legislature appears to have taken action not a moment too soon.

State Action Targeting State Employee Health Plans

New Mexico

New Mexico passed Senate Bill 376 in 2025 to authorize hospital price caps in the state employee health plan. Savings will help to offset enhanced financial support for state employees struggling with health care costs. The New Mexico Health Care Authority issued guidance dictating that starting July 1, 2025, the Authority would no longer reimburse urban in-network hospitals more than 200 percent and out-of-network hospitals more than 175 percent of the Medicare rate. The limits apply only to hospitals located in counties with populations of 125,000 or more.

Washington

In 2025, Washington addressed persistent affordability challenges in its public employee health plans and worked to better support its primary care and outpatient behavioral health workforce. SB 5083 caps prices paid for hospital inpatient and outpatient services for state and school employee benefit plans, with exemptions for certain critical access hospitals and sole community hospitals, beginning on January 1, 2027. Prices are capped at 200 percent of Medicare, with modified caps established for children’s hospitals. The legislation also defines minimum reimbursement limits for in-network primary care and community-based behavioral health services at 150 percent of Medicare.

More state action is coming. Multiple states are developing legislative proposals for the 2026 and 2027 legislative sessions aimed at reining in excessive hospital prices and price growth. In addition, some states that pursued legislation in 2025 without success, like New York, will likely try again. Legislation targeting hospital prices once seemed politically unfeasible, but affordability concerns have placed them on the agenda.